As countries across Europe, including the UK, struggle to live up to their net-zero pledges, a new report suggests that linking executive bonuses to sustainability goals has done little to help. More than half of executives with sustainability bonus clauses received their full bonus in 2022, as targets were largely found to be “easy to hit”.

Linking pay and benefits to ESG performance – particularly in the case of executive performance bonuses – has long been touted as a ‘game-changer’ when it comes to accelerating the push forsustainable business. While environmental, social and governance matters have been factored into a executive pay, though, a new study suggests this has been tokenistic at best.

A report from PwC and the London Business School has found that more than three-quarters of Europe’s largest companies now include a carbon target in some form as part of their executive pay packages. However, the extent to which these genuinely incentivise new ESG initiatives has been called into question, with the suggestion many of the sustainability targets were low-hanging fruit.

The researchers evaluated Europe’s 50 biggest corporations, according to their operation and disclosure of carbon executive pay targets. They received one point for basic offerings, and two forbetter or more detailed offerings, across four criteria: the significance of their targets; their measurability; how transparent those targets were; and how firms disclosed the links between their executive pay and their long-term carbon policy.

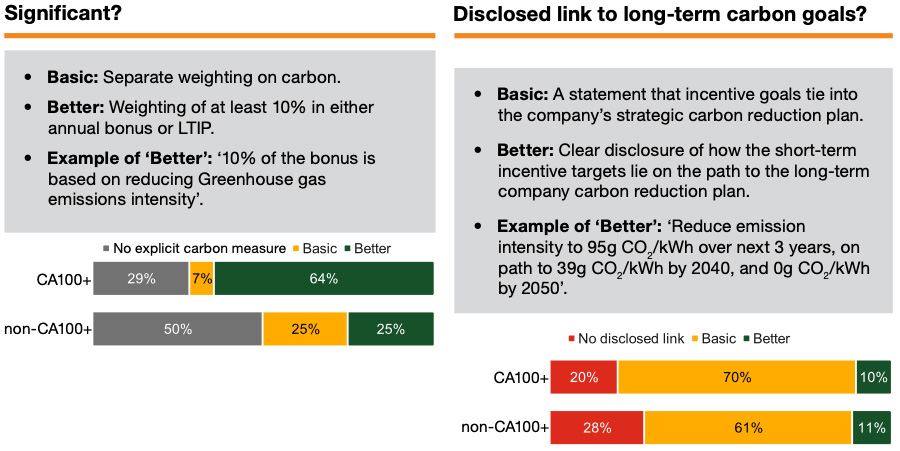

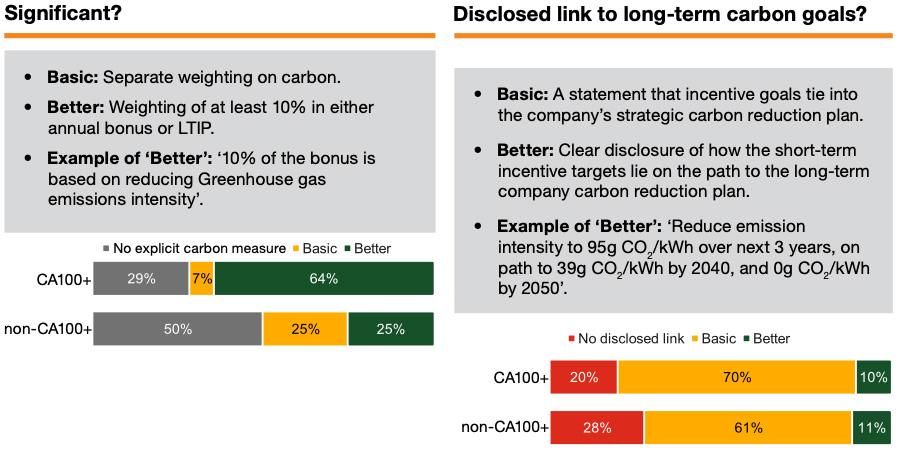

When looking specifically at the significance of the goals tied to executive pay, better performance would see firms weighing at least 10% of annual bonuses relating to carbon goals. Of the firms in question, those which were signatories of net-zero benchmarking organisation Climate Action 100+ performed best – with 64% reaching this standard; but still, 29% had no explicit policy at all. This rose to 50% of non-CA100+ firms.

Worse, a minority of both groups were committed to clearly disclosing how the short-term incentive targets lay on the path to long-term company carbon reduction plans. Only 10% of CA100+ firms lived up to this – actually lower than the 11% of non-affiliates. The majority of both groups instead did the minimum of issuing a statement insisting that incentive goals tied into the company’s broader plans. Meanwhile, more close to one-third had no disclosed link.

When it came to overall scores, this meant that the majority of companies either performed poorly when it came to carbon executive pay targets. A 44% chunk had no disclosed measures, while an additional 16% were found to have only the most basic level of targets in place. Just 14% were performing at a higher level.

This lacklustre ‘robustness’ of green bonuses means that the majority of executives have not been impacted by them in a meaningful way. PwC found that of the carbon target-linked pay outs by companies in the Stoxx Europe 50 index disclosed in 2022, half were paid out at 100% of the available bonus pot. The average for all pay outs was 86%. The slow progress being made on climate change will undoubtedly see eyebrows raised at the bonuses executives are continuing to rake in.

However, Phillippa O’Connor, workforce ESG leader at PwC, insisted that the inclusion of related targets could still yield big results, adding, “The challenge now must be to do it well, so that pay targets make a meaningful contribution to helping companies meet their climate goals.”