Despite continued hype for an approaching ‘cashless-society’, physical currency remains a dominant payment method for consumers around the world. However, British consumers bucked a global trend, as debit cards proved the most popular payment method across the UK.

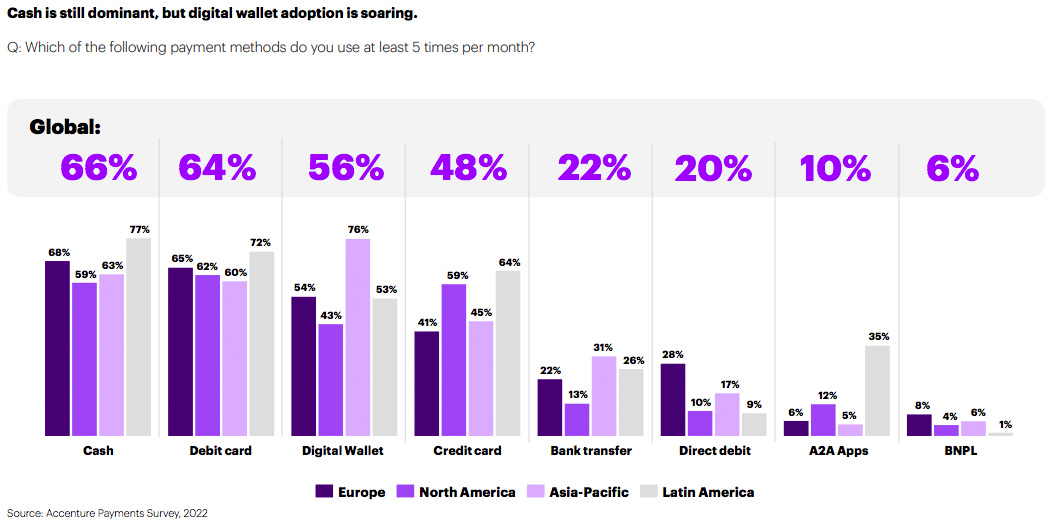

An Accenture survey of 16,000 customers in 13 countries spanning Asia, Europe, Latin America and North America, has discovered that cash is still king for the majority of the world. An average of 66% used cash to pay for things at least five times per month – ahead of 64% who used debit card at the same rate.

Cash was also the most popular payment method across Europe, with 68% of consumers favouring it – while 65% used debit cards. Surprisingly, amid the cost-of-living crisis, many individuals were trying to live within their means, too, as fewer than half used credit cards at least five times every month – sinking to 41% in Europe.

British consumers bucked these trends to an extent, however. Possibly due to more vendors accepting cards than many mainland European nations, 75% of 3,000 UK consumers Accenture polled used debit cards. While cash was still the next most popular option, the number using it as often fell to 63% – well beneath the European average.

At the same time, UK consumers are generally more cautious than global consumers when it comes to using a ‘digital wallet’ – making payments through apps such as PayPal, Apple Pay or Google Pay. Regarding small ticket purchases for retail or services of the likes of groceries, clothing, transport, the most popular in-person payment methods were cash at 33% and debit cards at 36%, compared to digital wallets, which were used by just 6%. Meanwhile, consumers favoured credit cards at 41%, or debit cards at 38%, for big ticket purchases such as appliances, technology, and travel.

According to Accenture, while the UK’s transition towards a ‘cashless society’ has been believed an inevitability, the country is lagging when it comes to digital wallets, as consumers still trust cash best due to its accessibility, convenience, and ability to budget in the current ‘high inflation macro-economic climate’. At present, banks have been slow to bring digital wallets – more closely associated with impulse buying at present – in line with this, and create a balance that will earn consumers’ trust.

This is contributing to notable risk of payments revenues becoming disrupted in the future, according to the study. The researchers contend that there is an untapped revenue potential in the switch to next-generation payments options. This is also seen at a global level, where some $89 billion is estimated to be at risk from consumers switching to alternative payment methods if current providers do not move to improve their digital wallet offerings.

The UK is no exception here. As per a press release from Accenture, the study calculated that as much as £366 million of UK payment revenues could face risk in the next three years, with traditional lenders proving slow when it comes to investing in next-generation payments options, and they risk having market share lost to new digital payment providers.

Sulabh Agarwal, Global Payments Lead, Accenture, commented, “The UK’s transition to becoming a “cashless society” depends on lenders is striking the right balance. There is clearly an untapped revenue potential in the shift to next-generation payments options, and Brits have made clear they believe biometrics will be their go-to method of payment in the near-future. However, digital solutions are not right for everyone or every situation, therefore a truly “cashless” society will remain a distant reality.”