As a new year brings a number of uncertainties to a head, businesses must reckon with challenges regarding digitalisation, sustainability and economic chaos. To help clients prepare for the future, consultants have shared their views on what 2023 may look like, with Consultancy.uk.

Despite optimism early in 2022 that the global economy was ready to kick on, after two years of uncertainty amid the Covid-19 pandemic, things did not pan out that way. The huge profits enjoyed by the world’s wealthiest amid lockdown meant that heightened inflation was already stinging consumer confidence before the Russia-Ukraine war saw fuel prices climb to record highs – further causing spending to fall.

With no end to the crisis in sight – in spite of various assertions through the last 12 months that the coming recession would be ‘short’ – businesses have a myriad of challenges to contend with in 2023. On top of pricing issues, they also need to consider how to guard their bottom lines, protect themselves from fraud, and keep up with ESG demands to satisfy investors. With that in mind, consultants from across the industry have highlighted which trends they expect to dominate their respective markets this year.

Pensions

2022 saw pensions consultants in high demand – as many schemes faced hard times amid the economic slowdown. Iain McLellan, Head of Research & Development at Isio, noted that the New Year looks like it will be another busy period of change for the pensions industry. The sector will face a number of challenges – both in terms of market shifts, and regulatory responses.

McLellan elaborated, “New Pensions minister Laura Trott sharing her priorities and hopefully committing to a timeframe for implementing the 2017 Auto Enrolment recommendations and publishing Baroness Neville-Rolfe’s review of the State Pension Age. Meanwhile, there will be continued fallout from 2022’s market volatility with trustees implementing revised investment strategies and responding to the regulatory response – reduced levels of leverage and greater liquidity to support LDI strategies. And trustees will be battling to respond to increasing governance demands… while also facing a ramping up on ESG focus – including the introduction of TNFD requirements not to mention the possible regulation of ESG ratings.”

Looking to pensions administration, meanwhile, Isio’s Director of Pensions Administration, Samantha Coombes, added, “Achieving clean scheme data that is fit for purpose is going to be high on trustee agendas in 2023. This isn’t a “nice to have” anymore – exercises such as GMPE, dashboard readiness, digital member admin and strategic activity make it an absolute must. Trustees will be looking at how they can achieve this aim in a cost-effective and proportionate manner.”

Telecoms

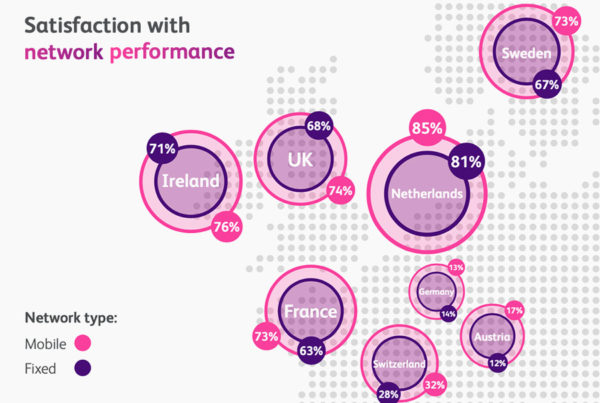

Looking to telecoms, trends from the pandemic mean that many on-going projects are yet to be completed going into 2023. Meanwhile, the spiralling cost-of-living crisis is also putting pressure on telecoms operators.

On the former, Caroline Gabriel, Research Director, Analysys Mason, commented, “Telecoms operators will continue to invest in fibre and 5G infrastructure. FTTP investment will continue to grow and infraco joint ventures will shoulder a greater share of the financial burden. Telcos will move to FTTP pushed by competition from other technologies and pulled by an increasing number of consumers demanding high-bandwidth services that are not adequately supported by current broadband connections or preferring FTTP for reasons such as its better reliability. Traditional telco capex budgets are constrained by the need to invest in 5G, but the long-term value of fibre (and utility-like models) will continue to attract outside investors.”

Meanwhile, Larry Goldman, Chief Analyst, Analysys Mason, said of pricing issues, “Price rises for telecoms services will become a political issue. Elected officials have largely left pricing issues up to regulators for the past decade. Operators and regulators will be under pressure to moderate price increases, especially on consumer services. We believe that operators will be able to raise retail prices, but it is possible that ARPU will not keep pace with inflation, meaning a cut in real terms. However, it is worth remembering that telecoms services are a relatively small part of any household budget and the annual price increases will be far lower than those for other products and services, such as food and energy.”

Fraud

As the global economic picture darkens, opportunistic criminals will be looking to make the most of many people’s desperation. This means that fraudsters will be seeking out new opportunities at record rates, according to Alastair Lauder, Managing Consultant and financial crime expert at Valcon.

Lauder explained, “Consumers and financial institutions will be embattled in the New Year, facing a tsunami of fraud and other financial crime. In times of financial hardship, as with the current cost of living crisis, more people are driven to look for elicit sources of income, so we see trends like internal fraud, friendly fraud and a range of scams emerge. Scammers are clever and often one step ahead – fooling people is their area of expertise, so people have to be on their game.”

In response, this is likely to cause a spike in regulatory activity in the financial sector. Among the actions will be a new FCA Business Plan for 2022/23. Valcon expects this will see the FCA aim to become more ‘data led’ in 2023, putting more emphasis on the analytical tools the regulator has built using synthetic data. This will help to slow the growth in automated push payments and fraud losses and slow the growth in investment fraud victims and losses. Other changes may include a prohibition of cash purchases over €10,000.

Technology

2023 is also a year when many sea changes for businesses using technology may take place. One of the most hyped technologies in recent years is the metaverse – but according to Jean-Francois Bobier, Director of Boston Consulting Group’s Technology & Digital Advantage wing, 2023 may be the year businesses simply drop the term entirely.

Bobier explained, “With multiple different technologies underpinning the metaverse, and implementations routinely failing to meet the hype that creators promise, there’s a good chance that over the next few years we’ll see major businesses and brands move away from the term entirely. And this is probably a good thing: developing better terminology to refer to implementations around the metaverse will help create stronger and clearer propositions for customers, rather than the somewhat nebulous ‘metaverse’. Apple is already leading the way with this trend with their refusal to refer to the metaverse at all, despite working on their ’Reality’ product line which is expected to be introduced in 2023.”

But this does not mean that the ‘nascent’ technology is anywhere near its potential, as Bobier hastened to add, “It will take at least 10 years to get to where we need for a fully scalable consumer experience. That said, corporate implementations might get there quicker as it will involve a far simpler and streamlined approach as opposed to fully interactive consumer propositions. We expect to see worlds with a strong focus on experiences to succeed in the meantime such as Roblox with its child audience or Fortnite with its social gaming focus.”

Sustainability

One of the major fears of bosses throughout the post-lockdown era has related to ESG targets. Investors are increasingly talking about walking away from firms that do not meet their sustainability criteria. According to Mike Dwyer, Head of Intelligent Industry at Capgemini, this is a possibility which businesses cannot ignore in 2023.

Dwyer noted, “While many businesses have already shared their commitments to net-zero, consumers are now demanding the proof. Increased scrutiny will be given to carbon reduction targets as firms not only assess how to reduce resources within factory walls but also beyond – looking at Scope 3 emissions across the entire supply chain.”

Graham Upton, Chief Architect Intelligent Industry at Capgemini, added that data could play a key role in meeting these demands, stating, “Navigating this unstable market requires complex decisions to be made quickly, relying on accurate and reliable data, and yet legacy infrastructure is still holding firms back. Shifting to a more digitally fluent culture, supported by the right technology infrastructure, will become a priority investment to unlock greater supply chain orchestration, balanced against business and ESG needs.”