After a sustained boom, subscription video services are suddenly having to contend with a slowdown – as falling consumer spending-power and market oversaturation leave many customers looking to cut their spend on entertainment. A new study suggests that allowing targeted advertising on platforms could help to ease the strain felt by the likes of Netflix.

For longer than a decade, streaming has been talked about as ‘the future’ of video-entertainment. Video-on-demand (VOD) Film and television that could be immediately accessed anywhere – from home, to the metro, to the office – was lauded by technophiles as being the natural successor to an inefficient delivery model that was witnessing declining returns.

Early market leaders Netflix and Amazon Prime saw rapid success with subscription-based models, which would deliver an almost limitless number of films and series to consumers instantly. When the Covid-19 pandemic hit, this model seemed perfectly positioned to win even more market share from traditional television operators – whose limited programming space was suddenly dominated by ominous news coverage, and public service announcements – and cinemas, who were unable to host audiences amid lockdown.

In this context, video subscription services like Netflix, Amazon, and established media behemoth Disney were tipped to see huge revenues from streaming in the coming years – with the UK’s streaming market alone expected to double in size to £16 billion by 2023. With the added appetite for remote content from the pandemic, pricing experts from Simon-Kucher & Partners felt the time might be right for the likes of Netflix to cash in on their growing subscription base, as ‘heightened price-elasticity’ meant that customers would be five-times more likely to tolerate a 10% price-hike.

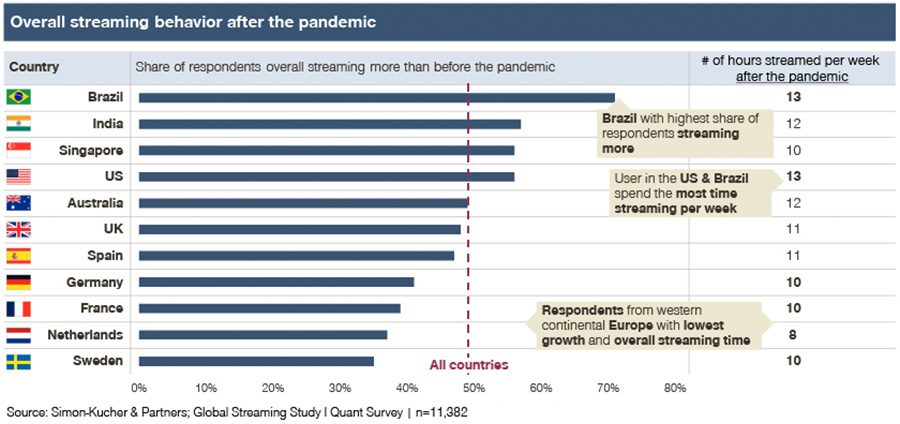

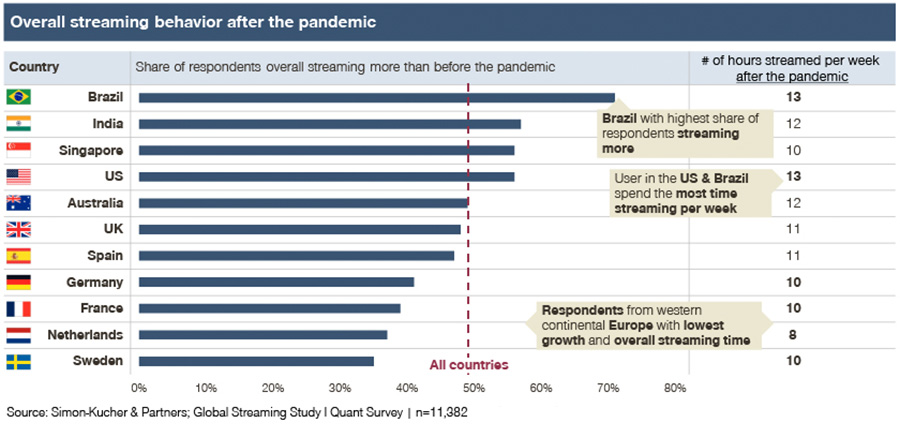

Simon-Kucher’s latest Global Streaming Study surveyed more than 10,000 respondents worldwide, and found more than 50% of global consumers consuming more VOD after the lockdown (the UK is slightly lower than average, but still sees people watch an average of 11 hours of streamed content per-week). However, despite these long-term behavioural changes, the opportunity to push up prices seems to have passed. In the months since lockdown, other trends have left video subscription companies are in a very different position from during the shutdown.

Record levels of inflation have hit consumers’ pay-cheques, while pay has remained relatively stagnant – greatly decreasing most people’s spending power. At the same time, having seen Netflix et al succeed by streaming content produced by Hollywood’s studio system, many conglomerates have followed Disney’s lead to cut out the middle-man, and launch their own subscription services. The over-saturated market, and declining consumer confidence, has led to the rise of what Simon-Kucher’s researchers are now referring to as ‘subscription fatigue’. Very few customers can afford to pay a fee to all these individual sources, so if they are doing so at all, they are choosing between the ones whose offer is a best fit for their tastes.

In the case of generalist Netflix, this has been devastating. Having seen almost constant growth in subscribers, the firm has haemorrhaged over 1,000,000 subscribers in the first half of 2022 – seeing share prices collapse by over 65% in the past 12 months. Amid this situation, the firm and its competitors are having to drastically re-evaluate their business model, in order to strengthen their bottom-lines without driving away more subscribers. According to Simon-Kucher, the best way to do that might be to finally accept advertising on their platforms.

The top reason for cancelling a subscription amid the cost-of-living crisis was, unsurprisingly, to save money – cited by 39% of respondents to Simon-Kucher’s poll. A further 30% said the price had been too high. This suggests price-hikes to strengthen revenues are off the table for streamers, unless they want to prompt a further exodus of viewers. In comparison, consumers were largely unconcerned with streamers using advertising to bring in more revenue. A smaller 13% said they had cancelled subscriptions due to this factor – suggesting this may be an easier way to go for most platforms.

Looking at the road ahead for subscription providers, authors Lisa Jaeger, Greg Harwood, Jochen Krauss, Sina Gansel and Jonathon Grant concluded, “Advertising is not necessarily a reason for users to unsubscribe, but high prices are… It’s clear that a stable or cheaper monthly subscription fee including advertising would be an attractive option for different customer segments. But there are also completely different hybrid models, known from music streaming services such as Spotify, that businesses should consider.”