Global mergers and acquisitions activity endured an extended slump in 2022. However, that may be as much due to the record performance being unsustainable as to do with macroeconomic changes, meaning 2023 may well see a rise in activity, according to new research.

Various research suggested that across all deal types, 2021 was a bumper year for mergers and acquisitions. Some estimates suggested deal value jumped from $3.7 trillion in 2020 to $5.3 trillion in 2021 – breaking decades-old records.

However, trends toward the end of that year had suggested the market was about to peak. After the anxiety of the first pandemic year, 2021 saw a rebounding economy heat the M&A market, with investors seeking strategic M&A multiples to make the most of the recovery. But this spike in demand also saw valuations spike viciously – leaving corporates paying more than ever for their targets, as they sought to navigate a rapidly changing and in many cases disruptive landscape.

In early 2022, it became evident that this kind of behaviour would simply be too risky in the coming year. The record profits enjoyed by many major corporations, crossed with low corporate tax burdens, led to a boom in the money circulating in the economy – driving a huge rise in inflation that would last the year. With wages still broadly stagnant, consumer spending power quickly shrank, and the recovery that had been so anticipated throughout the lockdown era swiftly stalled into a new recession, fuelled by falling consumption. At the same time, heightened oil and gas prices compounded this by burdening households with massive energy bills, even before Russia’s invasion of Ukraine further jeopardised fuel access.

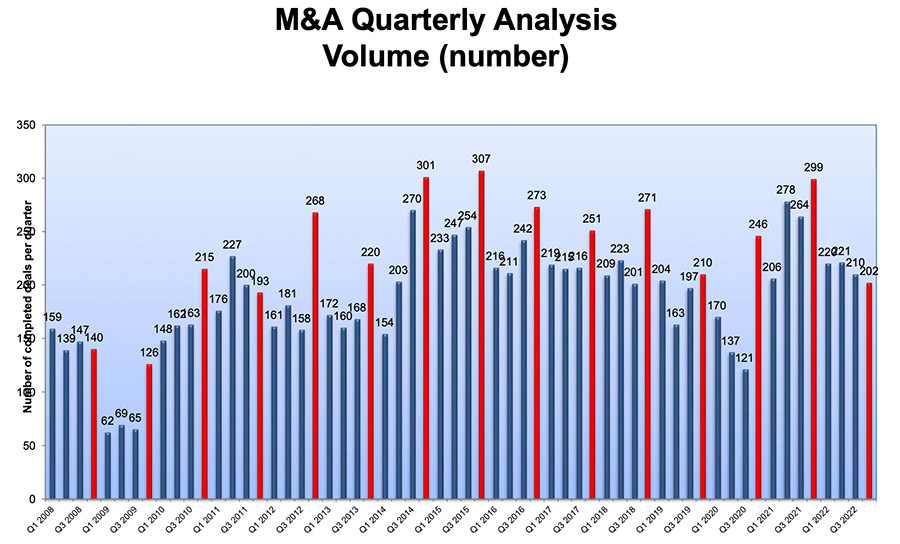

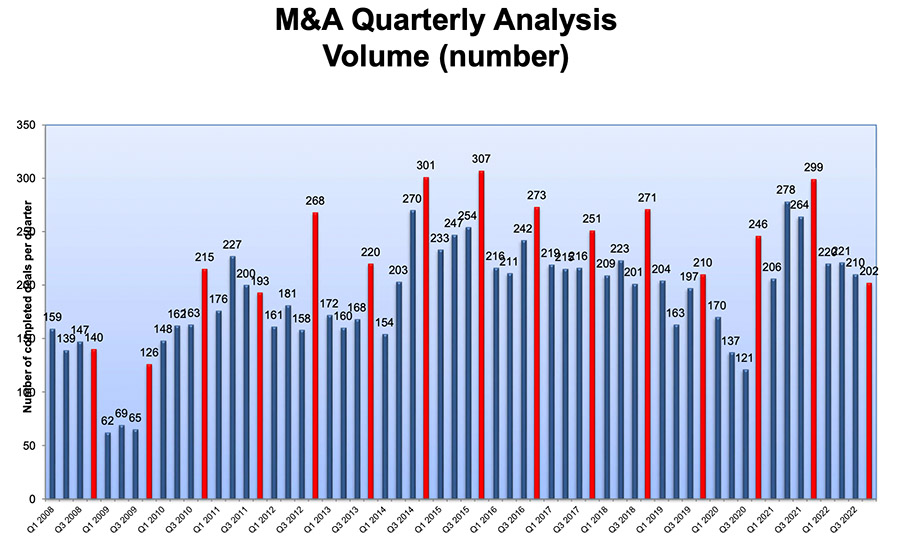

With so much economic, geo-political and social uncertainty on the horizon, spending huge amounts on investments that could struggle to return any value became unpalatable, to say the least. According to WTW’s M&A team, the total number of deals of all values fell in 2022 as a result. Deal volume in 2022 fell significantly by 19%, with 853 completed globally, compared to 1,047 deals in 2021. This was driven by a marked slowdown in M&A activity in North America – and a drop in buyer performance, putting more buyers off of deals.

In 2021, performance of acquired assets averaged out at +1.7 percentage points, compared to a -0.8 percentage point decline in 2022. This made the largest deals on the market particularly risky – leading to a markedly higher decline among them. Large deals declined by 28.7%, from 292 to 208 for 2022 – while the even-riskier 19 ‘mega deals’ of the last year fell by 21% to 15 mega deals in 2022.

However, looking ahead, WTW believes the M&A market may partially bounce back in the coming months. Jana Mercereau, Head of Corporate M&A Consulting for WTW in the UK explained that even as macroeconomic uncertainty seen last year will persist into 2023, the sustained performance of deals in 2020 and 2021 – also difficult years in many respects – prove “the ability of strategic buyers to succeed in challenging environments.”

Mercereau added, “While geo-political tensions, inflation and rising interest rates had an inevitable impact last year on deal activity and performance, the extraordinary pace set in 2021 was also unsustainable. Rather than being interpreted as a downward trend, current M&A volumes reflect a return to healthy pre-pandemic levels… In 2023, deals will still get done, [but investors will be] looking at target companies with an even finer lens, investing more time and resources to ensure quality due diligence, dealmakers will be well-placed to generate value and drive longer-term growth from deals.”